Ethic

code of ethics,然后再拓展就是standards of conduct。

Standards of conduct是serve as benchmarks for the minimally acceptable behavior required of members of a group.

Challenges to ethical conduct

- 通常会认为自己的是有伦理的人,而且道德标准高于平均水平。过度自信偏差。

- 决策者常常无法认识到和/或严重低估情境影响(situational influences)的效果,例如周围其他人在做什么;注意这是external factors

- 金钱:仅仅提及金钱就会减少道德行为

- 忠诚度:对同事或上级的忠诚会导致更容易认为不道德行为是可以做的

- 强力的合规政策也可能成为情境影响:员工会考虑“can”而不是“should”(compliance approach)

- 短视

Ethical 决策框架

公司管理层培养一种正直(integrity)的文化风气是提高员工守德行为的最重要因素:

- 第一步是确定code,表达公司的道德标准和对员工的行为期望

- 教授、加强和实践道德决策技能

Ethical 决策框架包括:

- 识别(identify):相关事实、利益相关者以及我对他们所负的义务、道德准则、利益冲突

- 考虑:情境影响、额外的指导(additional guidance)、备选项

- 决定并行动

- 反思:结果如预期吗?为什么或者为什么不?

Profession

profession:一个职业社区,具有特定的教育、专业知识以及支撑社区信任、尊重和认可的实践和行为框架。

坚持高道德标准的要求是专业人士与手工艺行会或贸易机构之间的明显区别之一。

profession如何建立信任:

- normalize从业者的行为

- 为社会提供一项服务

- 聚焦于客户(client focused)

- 有高准入标准(high entry standards)

- 拥有大量专业知识

- 鼓励和促进持续学习(continuing education)

- 监督职业行为(conduct)

- collegial(成员之间相互尊重,即使是互相竞争的关系)

- 是得到官方认可的监督机构(oversight body)

- 鼓励成员的参与行为(engagement):比如帮忙教育新的成员,比如促进标准的修订

- 是不断发展的

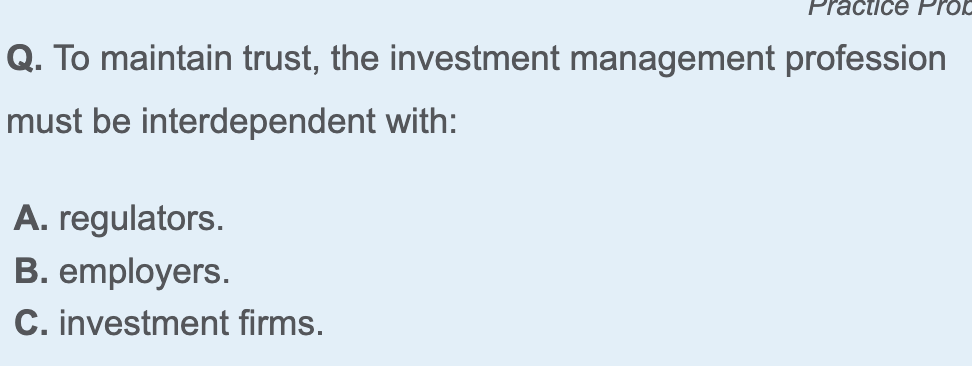

为了保持信任,投资管理profession需要和投资公司保持独立;与regulator和employer没有这个要求:

监管机构要求考虑suitability是legal standard;要求fiduciary(interest of client)则是既legal又ethical。

客户信任投资专业人士利用他们的专业技能和知识来服务客户并保护客户资产。

Professional Conduct Program

CFA治理委员会对PCP有监督和责任义务,与Disciplinary Review Committee (DRC)一同保证Code and Standards的实施(enforcement)。

CFA Institute Bylaws和Rules of Procedure for Professional Conduct构成了执行Code and Standards的基本结构。

Professional Conduct会通过以下方式监督会员:

- 所有人每年都需要在Professional Conduct Statement里面披露自身情况(比如是否涉及犯罪调查)

- 收到书面投诉可以进行调查

- 通过媒体、监管机构公告和其他公开途径了解到会员的问题

- 监考人员对考生的行为进行监控,并完成对考试当天涉嫌违反考试规则的考生的报告

- 考试后对分数和考试材料进行分析

措施可以从没有措施(无过错)、警告函到公开谴责、暂停会员籍甚至取消资格。但是不包括罚款。

the Rules of Procedure for Proceedings Related to Professional Conduct的两个原则是:

- 程序的保密性(confidentiality of proceedings)

- 过程的公平性(fair process to the member and candidate)

Asset Manager Code of Professional Conduct是针对公司的,包括loyalty to clients, the investment process, trading, compliance, performance evaluation, and disclosure。

The CFA Institute Standards of Practice Council (SPC)负责维护和解释Code and Standards。

概览

The Code of Ethics:

- Act with integrity, competence, diligence, and respect and in an ethical manner with the public, clients, prospective clients, employers, employees, colleagues in the investment profession, and other participants in the global capital markets.

- Place the integrity of the investment profession and the interests of clients above their own personal interests.

- Use reasonable care and exercise independent professional judgment when conducting investment analysis, making investment recommendations, taking investment actions, and engaging in other professional activities.

- Practice and encourage others to practice in a professional and ethical manner that will reflect credit on themselves and the profession.

- Promote the integrity and viability of the global capital markets for the ultimate benefit of society.

- Maintain and improve their professional competence and strive to maintain and improve the competence of other investment professionals.

Standards of Professional Conduct:

- 专业性

- 遵守法律

- 独立和客观

- 禁止虚假陈述(misrepresentation)

- 禁止不当行为(misconduct)

- 资本市场的诚信

- 重大非公开信息

- 市场操纵

- 对客户的职责

- 忠诚、保守、谨慎(Loyalty, Prudence, and Care)

- 公平交易

- Sustainability

- Performance presentation

- 保护隐私

- 对雇主的职责

- 忠诚

- Additional compensation(除非所有相关方都有书面同意)

- Responsibility of Supervisors

- 监督下属尽责

- 如果没有足够的制度行使监督权,则拒绝职位

- 投资分析、建议和行动

- Diligence and Reasonable Basis

- Communication with Clients and Prospective Clients

- 直白的语言解释投资流程,及时披露改变流程的重大事件

- 展示重大风险和限制

- 识别投资过程的重要因素并与客户沟通

- 区分事实和观点

- 保留记录

- 利益冲突

- 披露冲突(完整,不仅仅是法律要求的)

- 交易优先级(客户和雇主优先)

- 推荐费

- 作为 CFA 机构member或 CFA candidate的责任

- 不可以参与损害CFA协会的名誉的事情

- 不可以混淆CFA、CFA候选人等名词

Professionalism

Knowledge of the Law

- 遵守法律和监管条例。

- 如果存在疑问,需要知道公司的关于获取compliance指导的policy和procedure

- 要遵守当地法律和the Code and Standards中更为严格的那个

- 不可以参与(participate)或者协助(assist)明知或应该知道属于violation的行为

- 对于产品分销的地区的法律做适当了解

如果知道客户或者雇主的行为是非法或者unethical的,必须脱离(dissociate或separate)该活动。如果直接与对象进行交流不成功的话(按顺序尝试):

- 向supervisor或者合规部门报告,引起雇主的注意

- step away and dissociate from the activity

遵守更为严格的那个,在这种情况下需要特别记忆:在more strict地区生活,但是商业活动或者客户在less strict地区,法律规定按照商业活动所在地或者客户所在地的法律行动,那么要遵守的是Code and Standards而不是more strict。

建议:1)stay informed;2)review流程;3)维护即时可用的参考文件

independence and objectivity

- must use reasonable care and judgment to achieve and maintain independence and objectivity in their professional activities

- not accepting gifts that will compromise their own or another’s independence and objectivity

如果可以,应该在接受客户的礼物之前向公司报告;如果“提前”报告做不到的话,应该向公司报告之前接收到的礼物。

recommendation必须传达真实意见,不受内部或外部压力的影响,并以清晰明确(clear and unambiguous)的语言表述。

压力来源:1)买方(投资组合经理)的压力,导致比如评级“通胀”;2)一级和二级基金经理以及第三方托管人经常安排教育和营销活动,向其他人介绍他们的业务策略、投资流程或托管服务;3)被投行同事压力,来保住投行的客户;4)研究对象(公司)报复(不允许参加电话会等)

要求向喜爱的慈善机构或政治组织捐款也可能被视为违反该规则。

最佳实践要求会员和候选人始终自费或由公司承担商业交通费用,而不是接受外部公司的付费旅行安排。

建议:

- Protect the integrity of opinions

- 创建限制名单:如果公司不愿意传播对企业客户的负面意见,应鼓励公司将有争议的公司从研究范围中删除,并将其列入限制名单,以便公司只传播有关公司的真实信息。

- 限制特殊费用安排

- 限制礼物(不是禁止礼物)

- 限制投资(限制参与IPO、私募股权等)

- 审查程序

- 独立性政策

- 公司应任命一名高级官员,负责监督公司道德准则和所有与其业务相关的法规的遵守情况。

mipresentation

特别是:禁止保证有波动的投资的特定收益(guaranteeing clients any specific return on volatile investments.);但是如果产品结构内置了guarantee或者有机构承诺cover损失,就不算在这个禁止范围。

禁止omission,不可以遗漏事实。同时,模型的结果不能作为事实来披露;这不意味着模拟的结果不可以用来marketing,只是需要fully disclosure。

不可以剽窃(plagiarism)

work completed for an employer。离职之后不可以再不署名直接使用以前的雇主的东西,包括在前雇主任职期间做的recommendation。

misconduct

dishonesty, fraud, or deceit or commit any act that reflects adversely on their professional reputation, integrity, or competence

没有尽职可能也算是违反这条规则。

filing个人破产或者无法支付账单不是必定违反这条;只有与fraud或者不当行为有关才算。

Integrity of Capital Markets

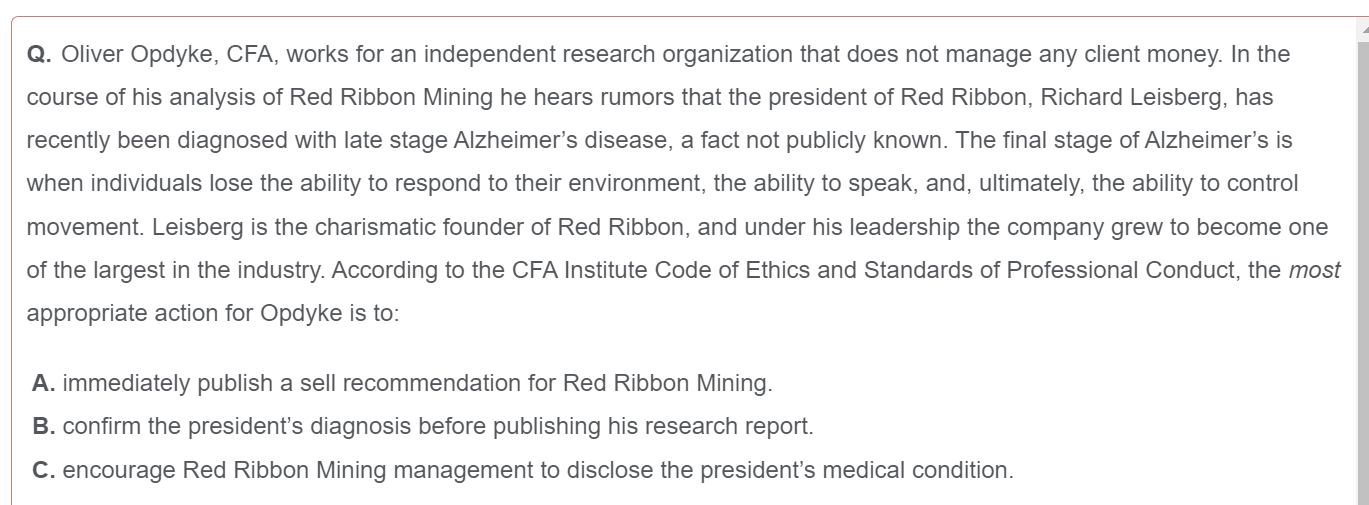

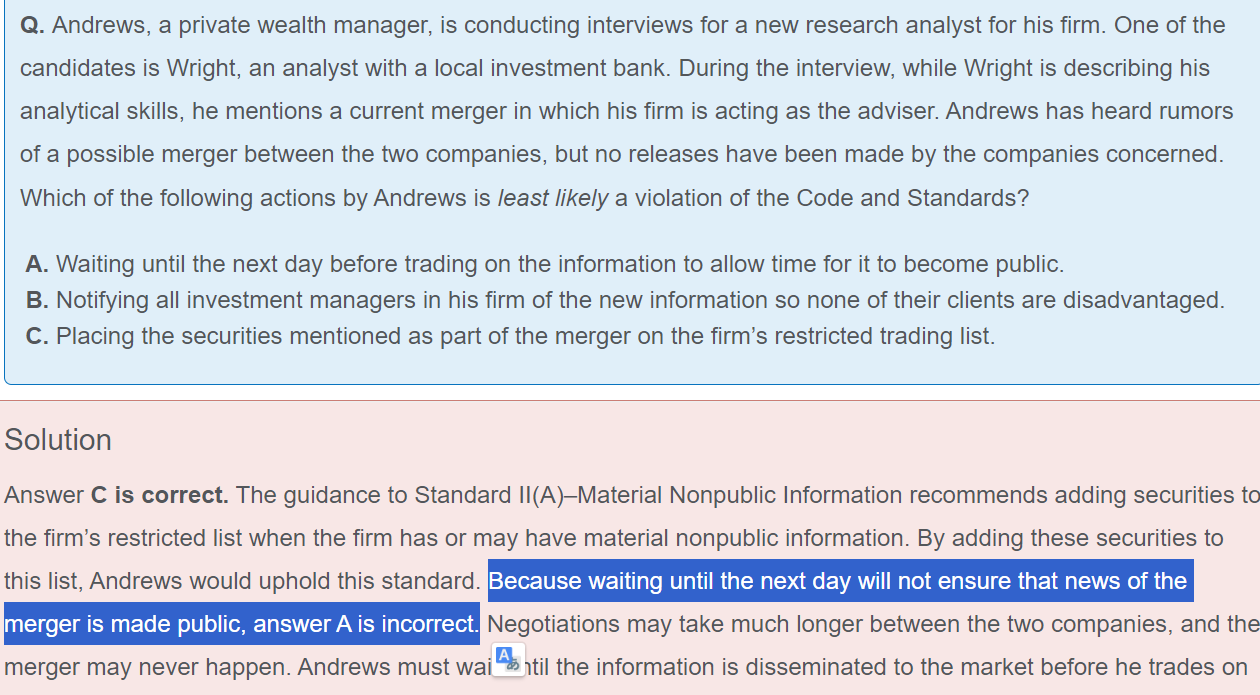

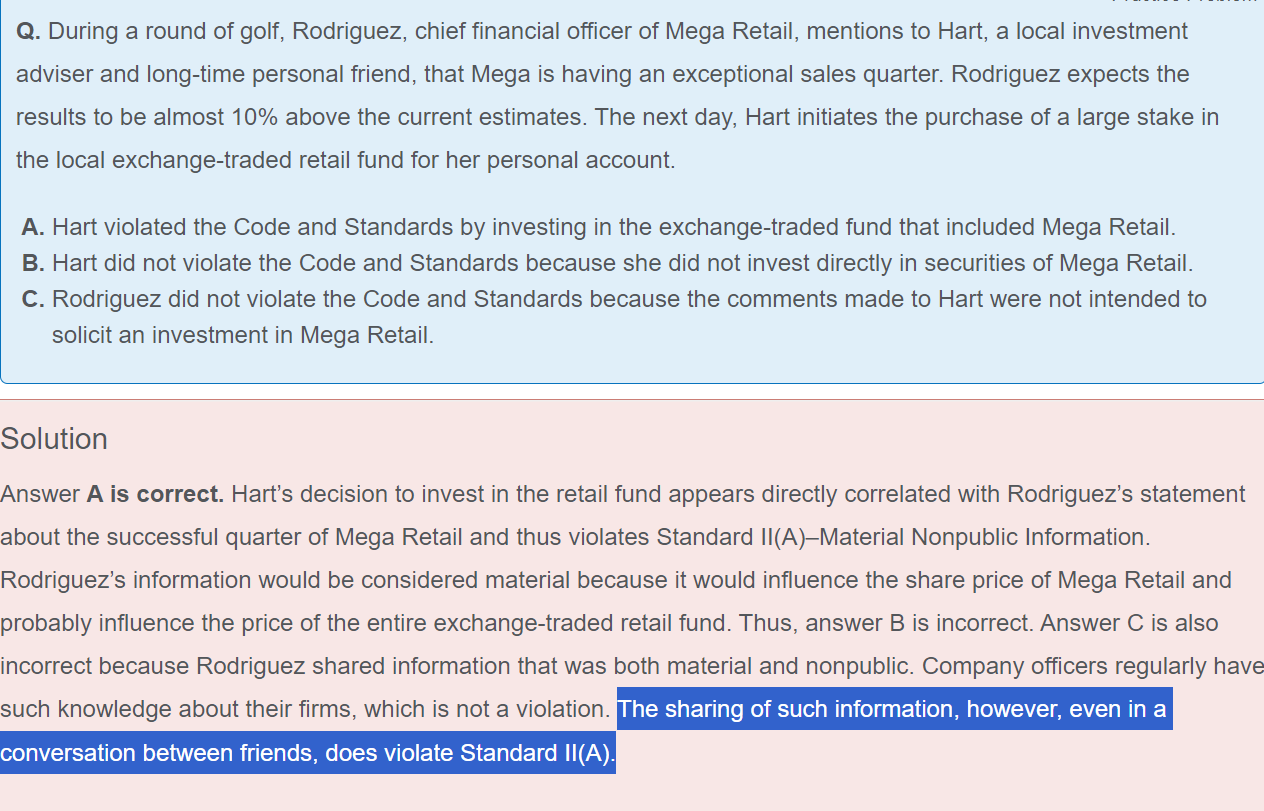

Material Nonpublic Information

must not act or cause others to act on the nonpublic information

如果披露信息可能对证券价格产生影响,或者合理的投资者在做出投资决策之前希望了解该信息,那么该信息就是“重大”的。考虑:具体性、与公开信息的差异程度、其性质以及可靠性

向一群分析师披露的信息并不一定使披露的信息“公开”。公司对分析师提供的对公开信息(比如财报)的指导或解释时,也不一定是公开信息。

用重大非公开信息进行进行尽职调查不是违规。

马赛克理论:通过公开信息以及非重要公开信息进行分析之后得出的结论,只要不是来自内幕,那么就不算做违规。但是需要对相关资料来源进行存档,以证明合法合规。

不可以引导公司内部人士提供这类信息:

“信息变成公开的”,第二天不一定够:

随口一说也是属于违规:

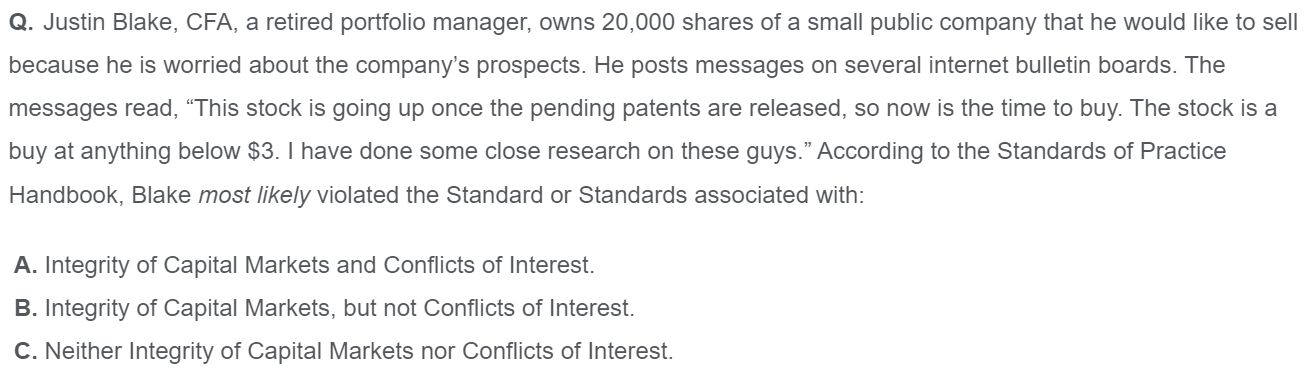

market manipulation

must not engage in practices that distort prices or artificially inflate trading volume

- 散布虚假或误导性信息(Information-Based)

- 通过扭曲金融工具的定价机制来欺骗或可能会误导市场参与者的交易(Transaction-Based)

利益冲突只涉及客户、潜在客户以及雇主:

duties to clients

Loyalty, Prudence, and Care

- a duty of loyalty to their clients and must act with reasonable care and exercise prudent judgment

- act for the benefit of their clients and place their clients’ interests before their employer’s or their own interests

对于“研究报告被很多non-client投资者关注”这种事,non-client是无所谓的,client优先不代表non-client的利益相关方优先:

第一步是确定“客户”的身份,对其应负有忠诚义务——比如养老金计划的“客户”就不是对方的经理,而是养老金计划的受益人。

无法避免其公司和客户利益之间的潜在冲突时,他们必须向客户清楚、客观地披露相关情况。

必须遵守客户为其资产管理制定的任何准则。投资决策必须根据整体投资组合的情况来判断,而不是根据投资组合中的个别投资来判断。

如果会员或考生支付比通常要支付的经纪佣金更高的佣金,以购买商品或服务,而客户没有相应的收益,那么就违反了对客户的忠诚义务。如果是客户指定经纪,那么不违反忠诚义务;但是也应该提示此时可能不是“Best execution”。

需要告知代理投票的policy。

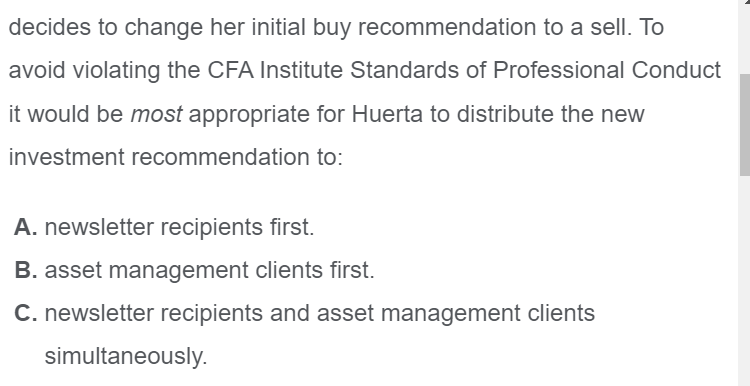

fair dealing

可以差异化服务,但是:1)不能对其他客户造成disadvantage和Negative effect;2)公示给客户和潜在客户,对所有人可用。

如果发行量超额认购,会员或考生应放弃向自己或其直系家庭成员出售股票,以便为客户释放出额外的股票。但是,如果投资专业人士的家庭成员账户与公司的其他客户账户类似管理,则不应排除家庭成员账户购买此类股票。

分配不一定要完全按比例,特别是存在最小交易量(低于这个量就会导致客户后续sale的流动性很差的话)。

sustainability

Performance Presentation

make reasonable efforts to ensure that it is fair, accurate, and complete.

不应声明或暗示客户将获得或受益过去的回报率

Preservation of confidentiality

duities to employer

loyalty

禁止 independent competitive activity that could conflict with the interests of their employer

- 得到consent from their employer to all of the terms of the arrangement之前不开展

-

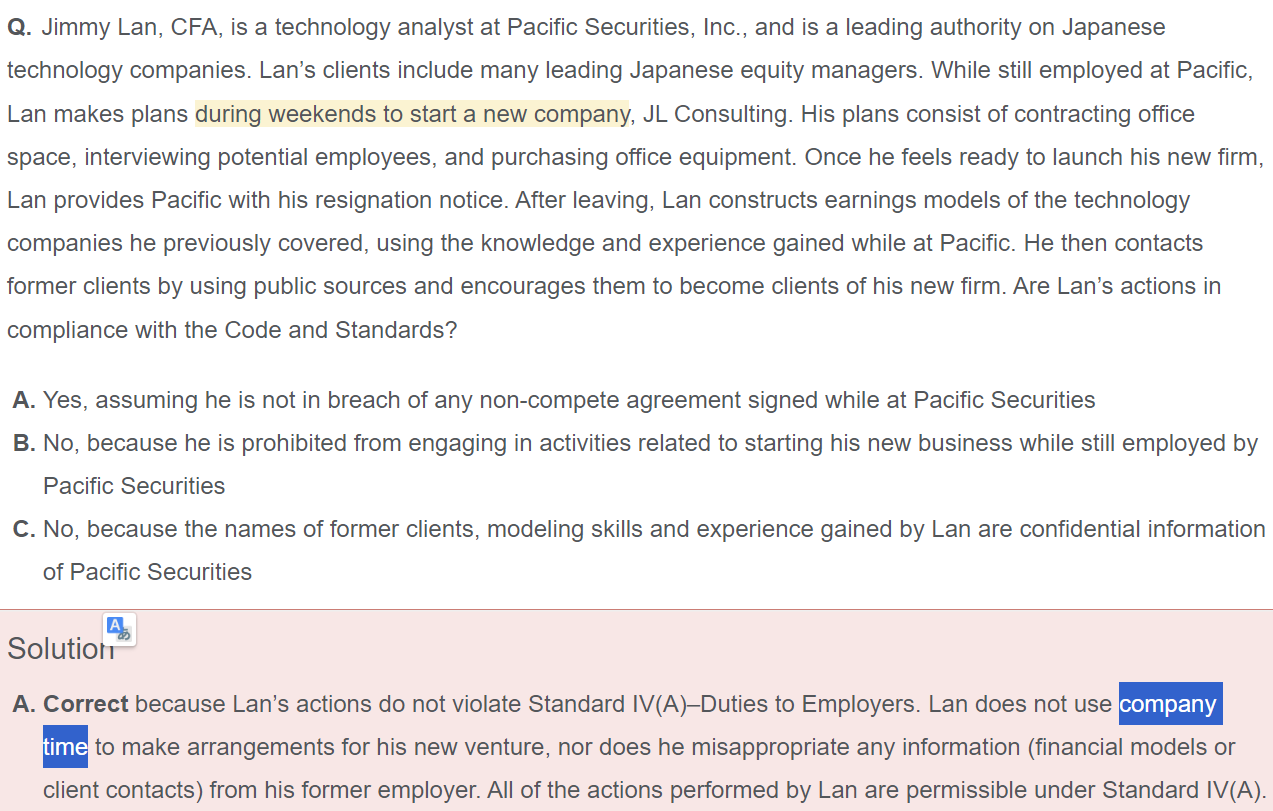

Undertaking independent practice不包括为开展这些活动进行的准备(preparations)

- 未经前雇主书面许可,会员或候选人不得将记录或文件交给新雇主。

- 员工在工作期间获得的技能和经验就不再是“机密”或“特权”信息

- 了解前客户的姓名和存在通常不是机密信息,除非协议或法律认为如此

- 并不禁止前雇员联系其前公司的客户,只要联系信息不是来自前雇主的记录或违反适用的“非竞争协议”

Additional compensation

must not accept gifts, benefits, compensation, or consideration that competes with or might reasonably be expected to create a conflict of interest with their employer’s interest unless they obtain written consent from all parties involved.

报酬和利益包括客户的直接报酬以及从第三方收到的任何间接报酬或其他利益。

报告的细节应由提供额外报酬的一方确认,包括客户提供的绩效激励。

responsibilities of supervisors

make reasonable efforts to ensure that anyone subject to their supervision or authority complies with applicable laws, rules, regulations, and the Code and Standards.

如果由于the absence of a compliance system or because of an inadequate compliance system,会员或候选人明显无法履行监督职责,则该会员或候选人应以书面形式拒绝接受监督责任,直到公司采取合理程序允许充分行使监督权

注意,建议的行为是 seperate a code of ethics from compliance procedure.

investment analysis, recommendation, and action

Diligence and Reasonable Basis

Exercise diligence, independence, and thoroughness

Have a reasonable and adequate basis, supported by appropriate research and investigation

如果作为小组成员出的报告,如果报告是有reasonable and adequate基础的,那么即使不同意报告的观点,也不一定拒绝署名。

可以用单一的资料来源,但是要做尽职调查。

communication with clients and prospective clients

Disclose the basic format and general principles of the investment processes and any changes that might materially affect those processes.

Disclose significant limitations and risks associated with the investment process.

Use reasonable judgment in identifying which factors are important to their investment analyses, recommendations, or actions and include those factors in communications with clients and prospective clients.

Distinguish between fact and opinion in the presentation of investment analyses and recommendations.

报告可以侧重于某些方面,touch另一些方面,并且可以把deemed unimportant的东西omit。

Record retention

develop and maintain appropriate records to support their investment analyses, recommendations, actions, and other investment-related communications with clients and prospective clients.

记录是公司的财产。当离开公司寻找其他工作时,未经前雇主明确同意,不得交给新雇主。

conflicts of interest

Disclosure of Conflicts

make full and fair disclosure of all matters that could reasonably be expected to impair their independence and objectivity or interfere with respective duties to their clients, prospective clients, and employer.

ensure that such disclosures are prominent, are delivered in plain language, and communicate the relevant information effectively

拥有所有权(股票)在利益相关的情况下也应该披露。

priority of transactions

transactions for clients and employers must have priority over transactions in which a Member or Candidate is the beneficial owner.

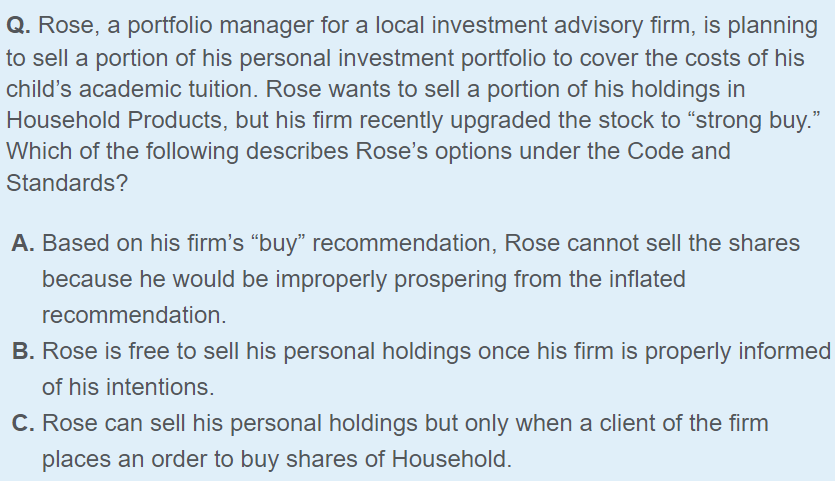

有时候做的交易可能跟对客户的建议相反(比如需要为学费出售股票),只要考虑三个条件是否满足:

- 客户不会因为这个交易disadvantage

- 我不会因为为客户执行这个交易而得到个人利益

- 符合法律法规

Family accounts that are client accounts should be treated like any other firm account and should neither be given special treatment nor be disadvantaged because of the family relationship.

限制期(禁止抢跑交易,就是先为个人账户交易然后再为客户交易)

referral fee

disclose to their employer, clients, and prospective clients, as appropriate, any compensation, consideration, or benefit received from or paid to others for the recommendation of products or services.

must advise the client or prospective client, before entry into any formal agreement for services, of any benefit given or received for the recommendation of any services provided by the member or candidate.

responsibilities as a cfa institute member or cfa candidate

Conduct as Participants in CFA Institute Programs

must not engage in any conduct that compromises the reputation or integrity of CFA Institute or the CFA designation or the integrity, validity, or security of CFA Institute programs.

可以对CFA协会、Program等表达不同意见,但是不能泄露考试相关信息。

reference to cfa institute, the cfa designation, and the cfa program

must not misrepresent or exaggerate the meaning or implications of membership in CFA Institute, holding the CFA designation, or candidacy in the CFA Program

member是指每年递交Professional Conduct Statement而且交会费的。如果membership不是active的也不能说自己现在是member。

Designation是协会授予个人使用才能用的title;而且必须要membership是active的才可以。

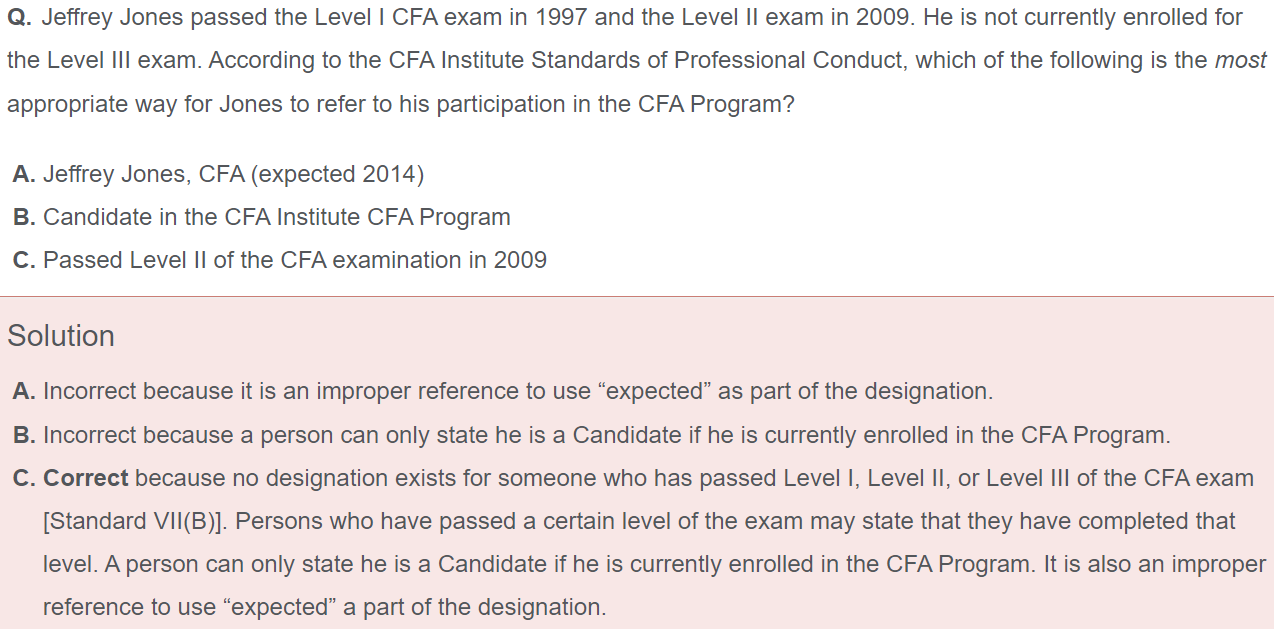

candidate指:要么registration已经被接受而且注册了某个特定的考试;要么考了试但是还没出结果。所以没有注册考试的不是candidate。

做题

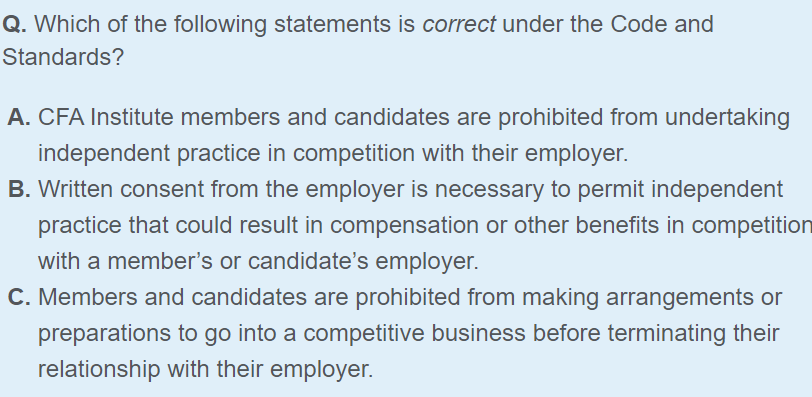

independent practice in competition with their employer,需要书面同意:

交易优先级:只要不对现有客户造成不利,员工的买卖就不会被限制:

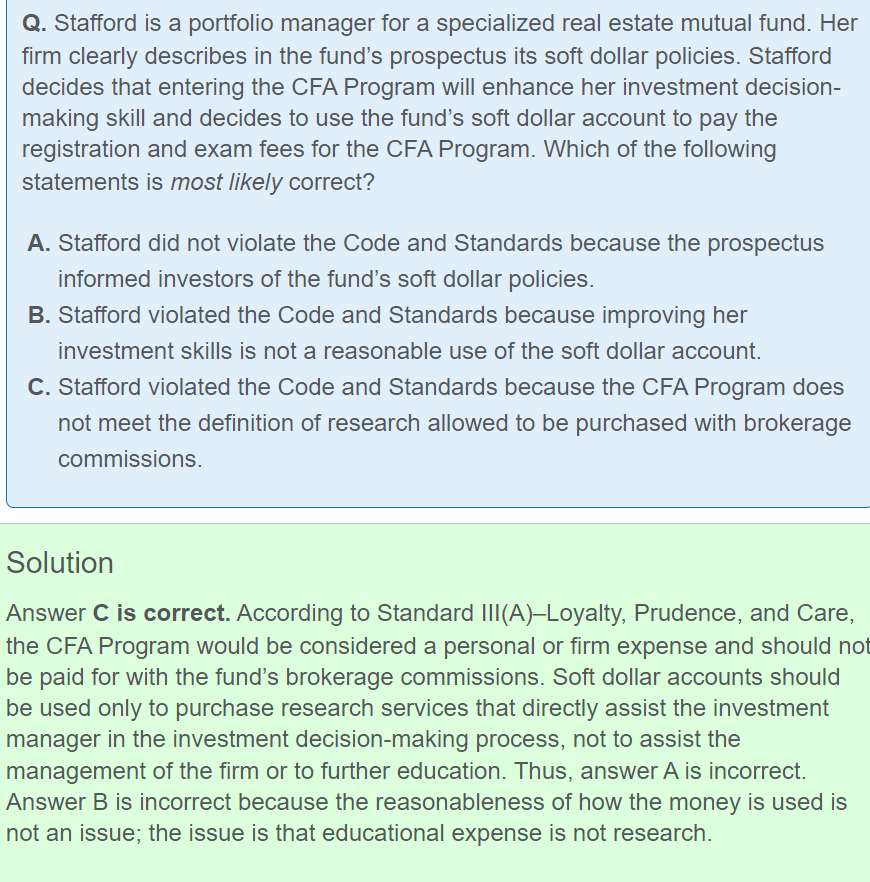

soft dollar只能用于research服务,而不是教育服务:

对雇主的责任,不用上班时间就不算违规:

如果流程不规范,第一步就是不接受任命:

推荐费要在达成协议前就声明:

客观性无论你是研究报告还是公关文都要求披露:

只有enrolled的才能叫candidate:

GIPS

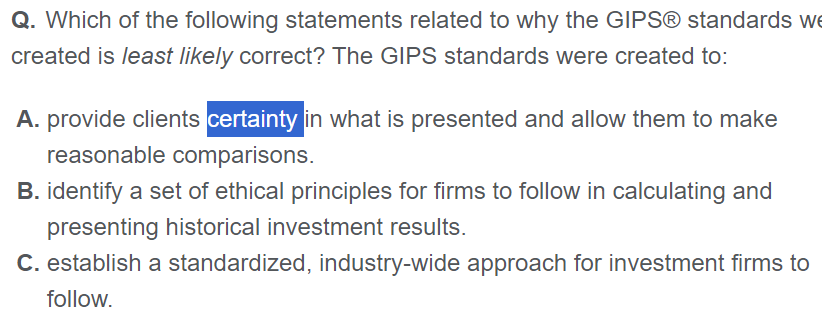

目的:to promote ethics and integrity and instill trust

原因:不同实践导致公司之间的Performance可比性较差,比如:选择表现最好的组合作为representative account;把表现不好的排除在外导致survivorship bias;只展示组合超过benchmark的时间段。

总的来说:ensure fair representation and full disclosure of investment performance

谁可以声明服从GIPS:

- 只有真的管理资产的公司才可以声称compliance

- 咨询公司(不管理资产的)不可以,只能说endorse

- 资产所有者如果compete for business,那也可以,否则应该声明服从的是GIPS for Asset Owners

- 只有fully和not comply两个极端,是公司层面的,不是产品层面的

关键点:

- Composite:A composite must include all actual, fee-paying, discretionary portfolios managed in accordance with the same investment mandate, objective, or strategy. all fee-paying discretionary pooled funds如果符合标准也要包含在composite内,而且至少要在一个composite内。

- If documented client-imposed restrictions interfere with the implementation of the intended strategy to the extent that the portfolio is no longer representative of the strategy, the firm may determine that the portfolio is non-discretionary. must not be included

- 认定为firm的范围:all geographical offices operating under the same brand name, regardless of the actual name of the individual investment management company.

- 验证Verification:不保证任何特定的Performance report的准确性。只是验证公司层面的compliance。

九个部分:

- Fundamentals of Compliance

- Input Data

- Calculation Methodology

- Composite Construction

- Disclosure

- Presentation and Reporting

- Real Estate

- Private Equity

- Wrap Fee/Separately Managed Account (SMA) Portfolios

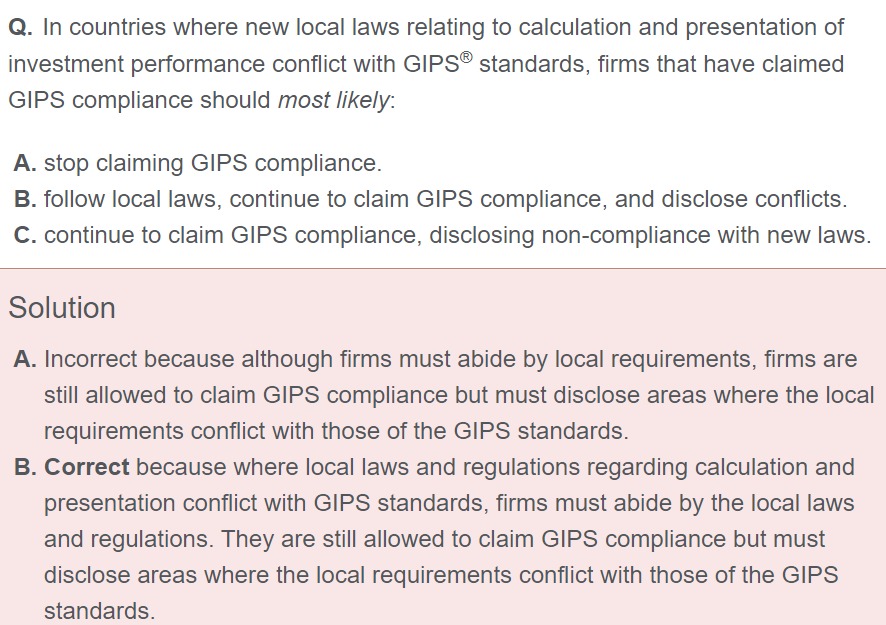

如果本地法律和GIPS冲突,那么公司必须遵守本地法律,同时允许继续声明遵守GIPS,但是需要disclosure conflict: